- Some Tributes to a Forgotten Revolution

- About John Maynard Keynes 1883 -- 1946

- Robert Reich on John Maynard Keynes

- James K Galbraith on Global Keynes

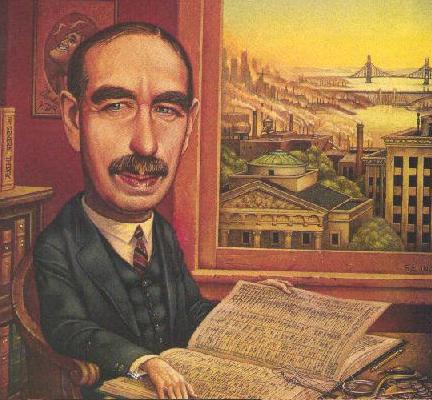

John Maynard Keynes

His radical idea that governments should spend money they don't have may have saved capitalism

By Robert B. Reich

He hardly seemed cut out to be a workingman’s revolutionary. A Cambridge University don with a flair for making money, a graduate of England’s exclusive Eton prep school, a collector of modem art, the darling of Virginia Woolf and her intellectually avant-garde Bloomsbury Group, the chairman of a life-insurance company, later a director of the Bank of England, married to a ballerina, John Maynard Keynes -- tall, charming and selfconfident -- nonetheless transformed the dismal science into a revolutionary engine of social progress.

Before Keynes, economists were gloomy naysayers. ‘Nothing can be done,” “Don’t interfere,” “It will never work,” they intoned with Eeyore-like pessimism. But Keynes was an unswerving optimist. " Of course we can lick unemployment! There’s no reason to put up with recessions and depressions! The economic problem is not -- if we look into the future -- the permanent problem of the human race", he wrote (liberally using italics for emphasis).

Born in Cambridge, England, in 1883, the year Karl Marx died, Keynes probably saved capitalism from itself and surely kept latter-day Marxists at bay.

His father John Neville Keynes was a noted Camridge economist. His mother Florence Ada Keynes became mayor of Cambridge. Young John was a brilliant student but didn’t immediately aspire to either academic or public life. He wanted to run a railroad. “It is so easy ... and fascinating to master the principles of these things,” he told a friend, with his usual modesty. But no railway came along, and Keynes ended up taking the civil service exam. His lowest mark was in economics. “I evidently knew more about Economics than my examiners,” he later exclaimed.

Keynes was posted to the India Office, but the civil service proved deadly dull, and he soon left. He lectured at Cambridge, edited an influential journal, socialized with his Bloomsbury friends, surrounded himself with artists and writers and led an altogether dilettantish life until Archduke Francis Ferdinand of Austria was assassinated in Sarajevo and Europe was plunged into World War I. Keynes was called to Britain’s Treasury to work on overseas finances, where he quickly shone. Even his artistic tastes came in handy. He figured a way to balance the French accounts by having British National Gallery buy paintings by Manet, Corot and Delacroix at bargain prices.

His first brush with fame came soon after the war, where he was selected to be a delegate to the Paris Peace Conference of 1918 -19. The young Keynes held his tongue as Woodrow Wilson, David Lloyd George and Georges Clemenceau imposed vindictive war reparations on Germany. But he let out a roar when he returned to England, immediately writing a short book, The Economic Consequences of the Peace.

The Germans, he wrote acerbically, could not possibly pay what the victors were demanding. Calling Wilson a “blind, deaf Don Quixote" and Clemenceau a xenophobe with “ one illusion -- France, and one disillusion - mankind” (and only at the last moment scratching the purple prose he had reserved for Lloyd George: “this goat-footed bard, this half-human visitor to our age from the hag-ridden magic and enchanted woods of Celtic antiquity”), an outraged Keynes prophesied that the reparations would keep Germany impoverished and ultimately threaten all Europe.

His little book sold 84,000 copies, caused a huge stir and made Keynes an instant celebrity. But its real import was to be felt decades later, after the end of World War Two. Instead of repeating the mistake made almost three decades before, the U.S. and Britain bore in mind Keynes’ earlier admonition. The surest pathway to a lasting peace, they then understood, was to help the vanquished rebuild. Public investing on a grand scale would create trading partners that could turn around and buy the victors’ exports, and also build solid middle-class democracies in Germany, Italy and Japan.

( from Time Magazine 29 March 1999)

Yet Keynes’ largest influence came from a convoluted, badly organized and in places nearly incomprehensible tome published in 1936, during the depths of the Great Depression. It was called The General Theory of Employment, Interest and Money.

Keynes’ basic idea was simple. In order to keep people fully employed, governments have to run deficits when the economy is slowing. That’s because the private sector won’t invest enough. As their markets become saturated, businesses reduce their investments, setting in motion a dangerous cycle: less investment, fewer jobs, less consumption and even less reason for business to invest. The economy may reach perfect balance, but at a cost of high unemployment and social misery. Better for governments to avoid the pain in the first place by taking up the slack.

The notion that government deficits are good has an odd ring these days. For most of the past two decades, America’s biggest worry has been inflation brought on by excessive demand. Inflation soared into double digits in the 1970s budget deficits ballooned in the’80s, and now a Democratic President congratulates himself for a budget surplus that he wants to use to pay down the debt. But some 60 years ago, when 1 out of 4 adults couldn’t find work, the problem was lack of demand.

Even then, Keynes had a hard sell. Most economists of the era rejected his idea and favored balanced budgets. Most politicians didn’t understand his idea to begin with. “Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist” Keynes wrote. In the 1932 presidential election, Franklin D. Roosevelt had blasted Herbert Hoover for running a deficit and dutifully promised he would balance the budget if elected. Keynes visit to the White House two years later to urge F.D.R. to do more deficit spending wasn’t exactly a blazing success. “He left a whole rigmarole of figures,” a bewildered F.D.R. complained to labor Secretary Frances Perkins. “He must be a mathematician rather than a political economist.” Keynes was equally underwhelmed, telling Perkins that he had “supposed the President was more literate, economically speaking.”

As the Depression wore on, Roosevelt tried public works, farm subsidies and other devices to restart the economy, but he never completely gave up trying to balance the budget. In 1938 the Depression deepened. Reluctantly, F.D.R. embraced the only new idea he hadn’t yet tried, that of the bewildering British “mathematician.” As the President explained in a fireside chat, ‘We suffer primarily from a failure of consumer demand because of a lack of buying power.” It was therefore up to the government to “create an economic upturn” by making “additions to the purchasing power of the nation.”

Yet not until the U.S. entered World War Two did F.D.R. try Keynes’ idea on a scale necessary to pull the nation out of the doldrums and Roosevelt, of course, had little choice. The big surprise was just how productive America could be when given the chance. Between 1939 and 1944 (the peak of wartime production), the nation’s output almost doubled, and unemployment plummeted-from more than 17% to just over 1%.

Never before had an economic theory been so dramatically tested. Even granted the special circumstances of war mobilization, it seemed to work exactly as Keynes predicted. The grand experiment even won over many Republicans. America’s Employment Act of 1946 -- the year Keynes died -- codified the new wisdom, making it “the continuing policy and responsibility of the Federal Government ... to promote maximum employment, production, and purchasing power.” And so the Federal Government did, for the next quarter century. As the U.S. economy boomed, the government became the nation’s manager and the President its Manager in Chief. It became accepted wisdom that government could fine tune the economy, pushing the twin accelerators of fiscal and monetary policy in order to avoid slowdowns and applying the brakes when necessary to avoid overheating. In 1964 Lyndon Johnson cut taxes to expand purchasing power and boost employment. ‘We are all Keynesians now,” Richard Nixon famously proclaimed. Americans still take for granted that Washington has responsibility for steering the economy clear of the shoals, although it is now Federal Reserve Chairman Alan Greenspan rather than the President who carries most of the responsibility

Keynes had no patience with economic theorists who assumed that everything would work out in the long run. ‘The long run is a misleading guide to current affairs,” he wrote early in his career. In the long run we are all dead.”

Were Keynes alive today he would surely admire the vigor of the U.S. economy, but he would also notice that some 40% of the global economy is in recession and much of the rest is slowing down: Japan, flat on its back; Southeast Asia, far poorer than it was just two years ago, Brazil, teetering, Germany, burdened by double-digit unemployment and an economic slowdown, and declining prices worldwide for oil and raw materials. In light of all this, Keynes would be mystified that the International Monetary Fund is requiring troubled Third World nations to raise taxes and slash spending, that “euro” membership demands budget austerity, and that a U.S. President wants to hold on to budget surpluses. You can bet Keynes wouldn’t be silent. Dapper and distinguished as he was, he’d enter the fray with both fists and a mighty roar.